Noble Gold

Review 2022

Hey there! You’re here because you want to learn more about Noble Gold or maybe you’re looking for a precious metals company to invest your money in. Either way, we’ll tell you everything you need to know about this dealer firm – the good, the bad, and the ugly.

We know it’s challenging to look for a secured and reliable dealer who performs as it's advertised to be. There are a lot of gold companies out there, and Noble Gold does not fall too far from the competition. Here, we will give a more comprehensive review about Noble Gold Investments.

Keep reading as we reveal every information you need to know about this dealer firm. We’re going to help you decide whether this is the right investment program for you. At the end, we’ll also answer some of the most common questions regarding Noble Gold investing.

Noble Gold Pros and Cons

In a hurry? Here’s a quick pros and cons of Noble Gold investing.

Pros

Pros

Cons

Cons

Our Noble Gold Category Rating

We researched the top-rated dealers in the market to determine how Noble gold performs against the competition. Here’s our detailed rating on the company.

Products & Services | 4.8 |

Pricing | 4.9 |

Customer Support | 4.6 |

Company Expertise | 4.5 |

Customer Feedback | 4.7 |

Overall Rating: | 4.7/5 |

What You Get With Hard Assets Investing:

Quick Summary: Why We Recommend Noble Gold

Overview: Noble Gold is top-notch. Not only do they offer excellent customer service, but also provide competitive minimums at $2,000 for IRAs and $5,000 for their Royal Survival Packs.

4.7/5 Rating

What We Like: Low minimums, wide range of products, excellent customer care, less than 5-minute account set up, expert advisors, and up-to-date resources

Promos: 1st-year fees waived for retirement accounts.

About Noble Gold

Founded by CEO and President, Collin Plume and co-partner Charles Thorngren, Noble Gold has been dealing with precious metals IRA since 2016. It also offers direct purchase of physical gold, silver, palladium, and platinum products.

The dealer firm works with Equity Trust in offering custodianship services. When it comes to safe keeping, your precious metal holdings are kept in a secured vault with the International Depository Services (IDS), located in Delaware or Texas. If you’re doing the transaction outside the US, it also has an overseas storage option located in Ontario, Canada.

In addition to IRA-eligible bullion products, Noble gold offers a range of rare collectible coins for non-IRA use. If you want to have an on-hand storage of physical bullion for emergency purposes, the firm offers Royal Survival Packs, which costs between $5,000 to $500,000

While this firm is relatively new, it has quite the visibility on social media. All its accounts from Facebook to Youtube offer up-to-date information on precious metals investing. You can also contact their representative if you need more assistance with their product offerings.

Noble Gold Products and Services

Noble gold offers the following account options to its clients.

1. Gold IRA Rollover

You can sign up for a self-directed gold IRA that allows you to hedge against stock market volatility by investing a part of your pension in gold. With this rollover retirement option, you can defer your tax payments or skip on paying capital gains tax. Below, we list some of the featured IRA-approved coins and bars.

American Gold Eagle

Canadian Gold Maple Leaf

Australian Gold Kangaroo

Australian Gold Philharmonic

PAMP Suisse Lady Fortuna Gold Bar

Perth Mint 10z Gold Bar

See all IRA-approved selections here.

2. Silver IRA Rollover

The operation and advantages of a silver IRA are similar to a gold IRA. The only difference is the metal type used as a fund, which enables rollovers from silver retirement accounts instead of gold. Here are some of the available silver products to include in your IRA.

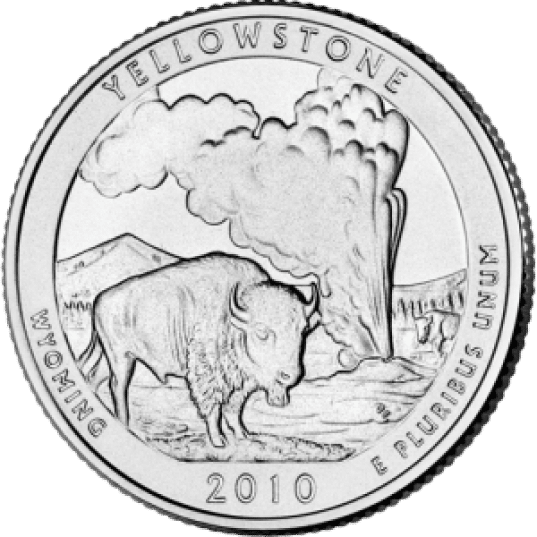

America the Beautiful Silver

American Silver Eagle

Canadian Silver Maple Leaf

Australian Silver Kangaroo

Highland Mint Silver Bar

Republic Metals Silver

See full list of IRA-approved silvers here.

3. Royal Survival Packs

If you’re looking to invest in an emergency fund rather than a retirement plan, Noble Gold offers Royal Survivals Packs. These are popular among survivalists who want to protect their wealth against future banking collapses or when currencies lose their worth.

Gold and silver coins are usually the go-to for most clients as they offer ease in trading. Because gold and silver IRAs entail some limitations, many specialty investors and coin collectors often opt for this account.

Another great benefit with the Royal Survival Pack is that you can get your assets delivered to your home. What’s more, you can rest assured your precious metals arrive safe because Noble partners with reliable and accredited depositors that offer specialized services.

Here are the account options with their required minimum investments.

- Noble Knight: $10,000

- Noble Baron: $25,000

- Noble Viscount: $50,000

- Noble Earl: $100,000

- Noble Marquess: $250,000

- Noble Duke: $500,000

4. Precious Metal Coins and Bars

You can also purchase physical precious metal coins and bars with Noble Gold. In addition to IRS-approved coins, you have access to rare coins like the 1854 Kellogg $20 Coin and Morgan Silver Dollars. Collectible coins to choose from include gold, silver, palladium, and platinum products in various weights.

Noble Gold Account Minimums and Fees

With Noble Gold, you won’t have to worry about setup costs, and taxes when rolling your IRA from one custodian to another. You can transfer your funds without penalty as long as you complete it within 60 days.

Once your account is setted up, you’ll be charged with a storage fee which costs between $80 to $150. The minimum investment for a precious metals IRA is $2,000 while Royale Survival Packs require between $5,000 to %50,0000.

Minimum IRA Investment | $2,000 |

Royal Survival Pack | $5,000 |

Annual Custodian Fees | Varies on provider |

Storage & Insurance Fees | $80- $150 |

Set Up Fee | FREE |

Noble Gold Storage Options

Noble Gold collaborates with the International Depository Services in providing storage facilities. It offers IRS-eligible vaults in the following locations:

New Castle, Delaware & Dallas, Texas

Mississauga, Ontario, Canada (Overseas)

These depositories are not only segregated but are also LBMA, COMEX/CME, and ICE-approved. Moreover these are also insured by the world-renowned Lloyds of London.

Noble Gold Reviews and Disputes

Below we compiled customer reviews from third-party rating companies. As we researched, we found quite a number of client reviews for Goldco. Here’s what we found:

Google Reviews

Noble Gold earned 4.9/5 stars on Google Reviews. Majority of the customers are saying they are pleased by the company’s extremely knowledgeable staff. They also loved how streamlined the process of setting a gold IRA was. But just like any other dealer firms, we also found red flags for Noble Gold. Some customers are saying they’re not as transparent and honest as they were advertised to be

4.9/5 Rating

Better Business Bureau (BBB)

The company has earned a solid 5/5 star rating from BBB. We also found no complaint filed against them in the past years.

5/5 Rating

Consumer Affairs

We found zero issue on Noble Gold at Consumer Affairs. Clients loved their top-notch customer support and personalized service.

5/5 Rating

TurstLink

Likewise, we found no dirt on Noble Gold on TrustLink. People commended the company for the streamlined precious metals sale and IRA rollovers. Some even go as far as saying, Noble Gold is the best dealer firm they’ve worked with.

You can click on the links below to see the actual review yourself.

5/5 Rating

Opening a Gold IRA with Noble Gold

Setting up a Gold IRA account with Noble Gold takes less than five minutes. Here are the steps to follow.

- 1Complete the online registration on their website.

- 2Receive a call from a Noble Gold agent.

- 3Provide the necessary credentials to open your account.

- 4Develop a plan based on your goals.

- 5Fund your IRA account with the amount you wish to convert.

- 6Select which precious metals you want to purchase and include on your account.

- 7Decide on shipment and storage facilities.

- 8Keep updated with your account to monitor your gains.

FAQs on Goldco Investing

Annual fees of $80 for management fees and $150 for storage applies when you open an account with Noble Gold. The storage fee is a bit more expensive than most dealer firms because of additional perks like segregated vaults and access to online monitoring accounts.

Opening an account with the company requires a minimum investment of $2,000 for a precious metals IRA. Noble Gold’s minimum is actually a lot cheaper than what the competition offers. Today, dealers in the market charge between $10,000 to $25,000 for account minimums.

Noble gold collaborates with the International Depository Services in safe-keeping your assets. You can rest easy; they provide top-notch security in storing you gold or silver products. These facilities are located in Texas, Delaware, and Ontario, Canada.

Yes. Noble gold is rated A+ on BB and has maintained positive feedback from clients since its foundation.

Noble gold offers the best rates for any gold, silver, platinum and palladium products you sell back to them. They always have your back when it’s time to liquidate your holdings.

The firm offers platinum and palladium coins and bars as well as rare coins in addition to gold and silver. You should know some of these may not be eligible to be included in your IRA. Make sure to contact a Noble Gold specialist first before making a decision.

Yes. Noble Gold is happy to serve US and international buyers alike. However, the only available storage option for any overseas transaction is the protected vault located in Ontario, Canada.

Noble Gold’s partner storage facility, International Depository Services (IDS) is sanctioned by the Intercontinental Exchange (ICE), COMEX/CME, and LBMA. It’s also insured by the Lloyd's of London – a world-renowned asset insurance provider.

Unfortunately no. Unless it’s your time to receive distributions, the IRS strictly stipulates that precious metals acquired through an IRA must be kept in a private depository vault. With Noble Gold, you can ensure your assets are fully secured as they only have a segregated storage option. That means, you can withdraw exactly which coins and bars you invested in as they are kept separate from other investors’ assets. Noble Gold also gives you the option to schedule an in-person visit or sign up for an online tracking of your holdings.

Noble Gold Review: The Bottomline

Overall, we believe Noble Gold has earned its great ratings from third-party review sites. It does not only offer a wide selection of precious metal products, but competitive pricing and fees as well. With just $2,000 you’re on your way to starting a gold retirement account!

Considering it has A+ ratings on BBB and consistent positive reviews onlive, we believe Noble Gold is a company you can trust! What’s more, apart from a few Google My Review complaints, we could not find any red flags on Noble Gold anywhere we went.

If you’re new to precious metals investing, we recommend you start with Noble Gold. They have all the resources you need and accommodating advisors to boot!